The turning point has begun – but not without risks.

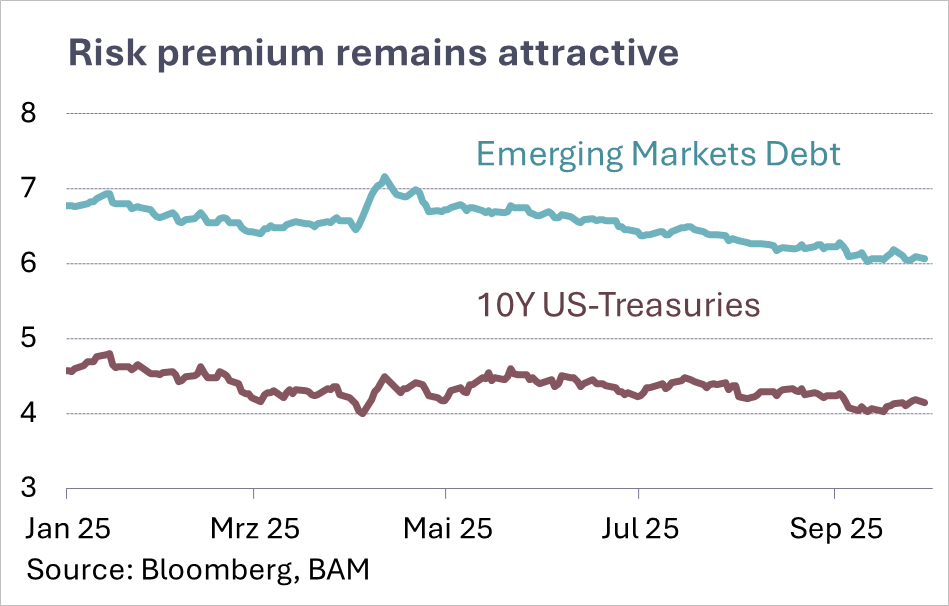

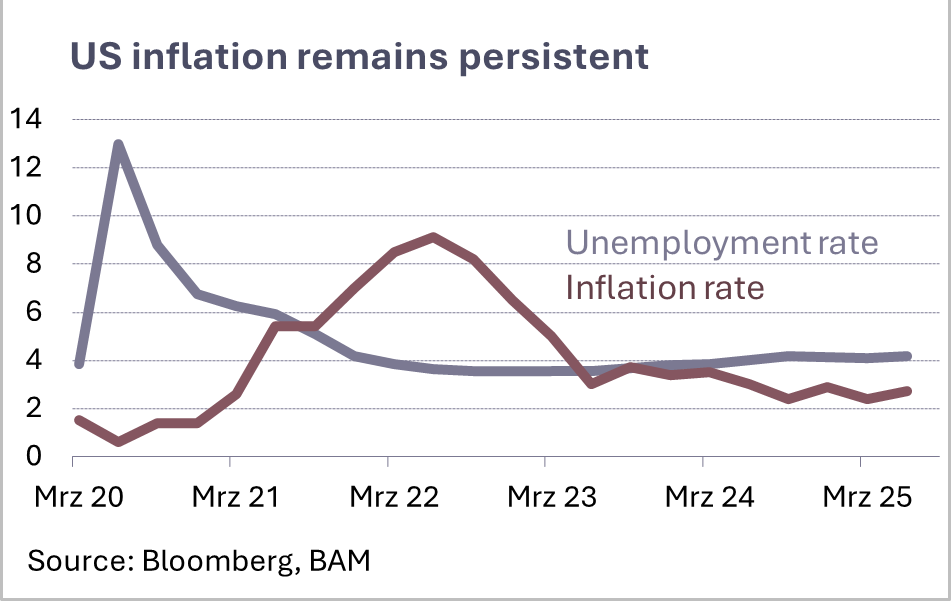

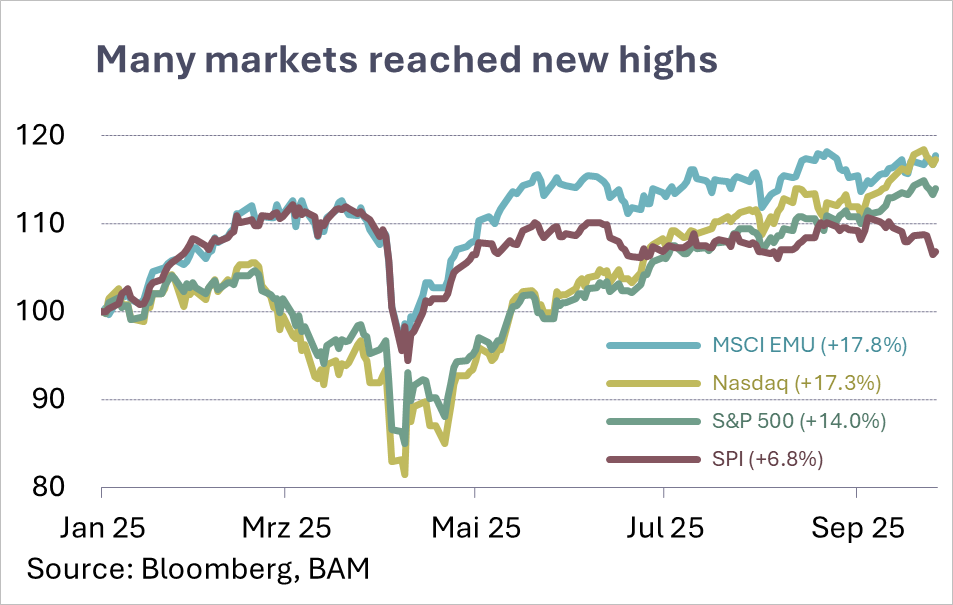

The interest rate landscape is shifting. In mid-September, the U.S. Federal Reserve delivered its first cut of the current cycle, a move long awaited by the markets. Two further rate reductions are expected before year-end. While the Fed is signalling relief for both the economy and credit markets, high levels of government debt remain a structural challenge. Yields on ten-year U.S. Treasuries remain elevated, as investors demand risk premiums, further limiting fiscal flexibility.

The European Central Bank, meanwhile, is in a “wait-and-see”-mode. After recent moves, uncertainty over wages, energy prices, and slowing growth is too high for a clear policy direction.

In Switzerland, the question is how long the National Bank will continue to resist negative rates. Should the Swiss franc come under renewed pressure, currency interventions may return to the agenda, although with caution, avoiding negative effects on

the already delicate trade negotiations with the US government.

Attention also turns to emerging markets. Many of these economies offered higher real interest rates from the start and now have inflation better under control. In an environment where the U.S. long-term yields remain high while the Fed eases short-term pressure, these markets may become increasingly attractive, both for capital inflows and for currency stability.