Tariffs, Earnings, Optimism: Markets in a Balancing Act

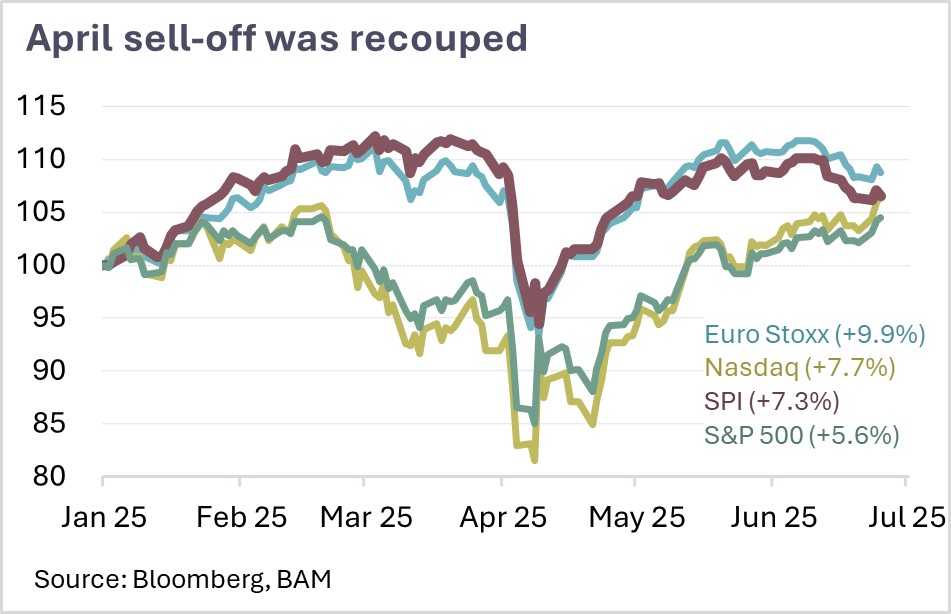

Q2 kicked off dramatically: the U.S. announced tariffs on all trading partners, triggering a global market selloff – political tactics absent clear economic rationale. Reason returned to the debate when Treasury Secretary Scott Bessent highlighted the risks of an escalating trade war. Negotiations resumed, and market jitters subsided.

Meanwhile, many companies reported solid to strong quarterly earnings. Optimism quickly returned in the U.S., with the S&P 500 rebounding significantly from recent lows. Europe and Switzerland also showed continued strength: the EuroStoxx 50 and SPI are near record highs, supported by stable margins, attractive dividend yields, and appealing valuations – especially compared to the U.S. tech sector.

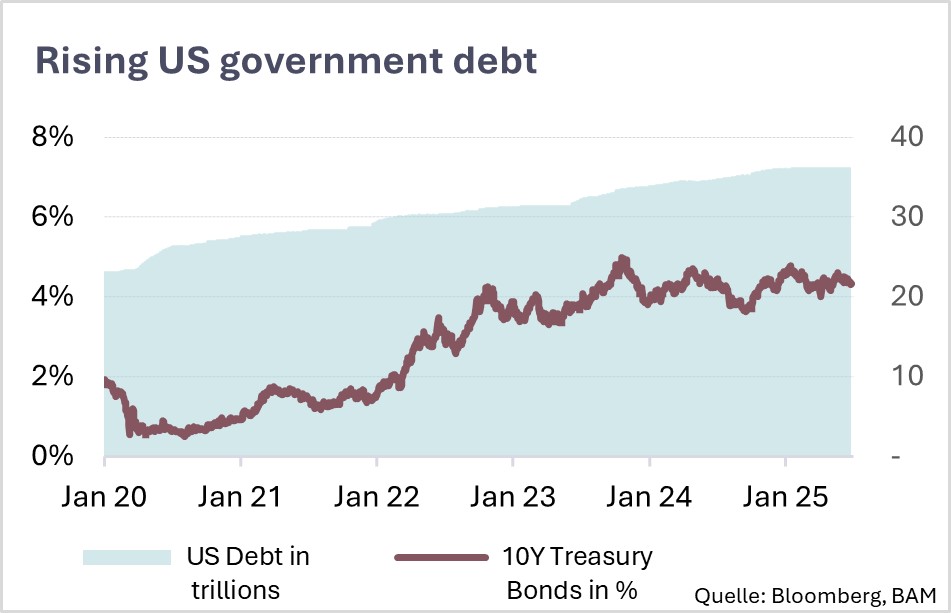

The weak U.S. dollar further aided the recovery, benefiting export-oriented European business models. That said, geopolitical tensions, interest rate uncertainty, and strong year-to-date performance all point to a potentially volatile summer – especially given seasonally lower trading volumes. Global diversification and a focus on quality remain key.