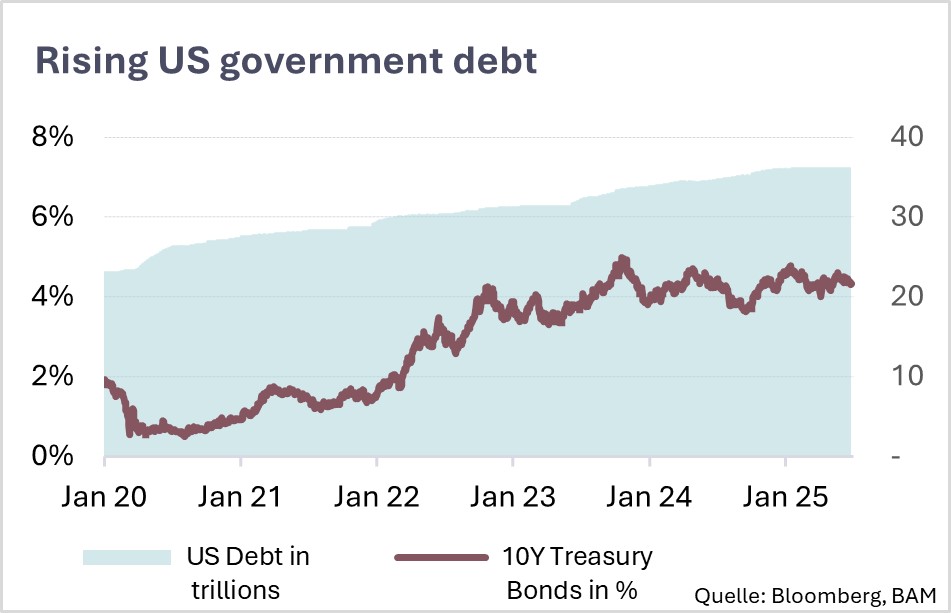

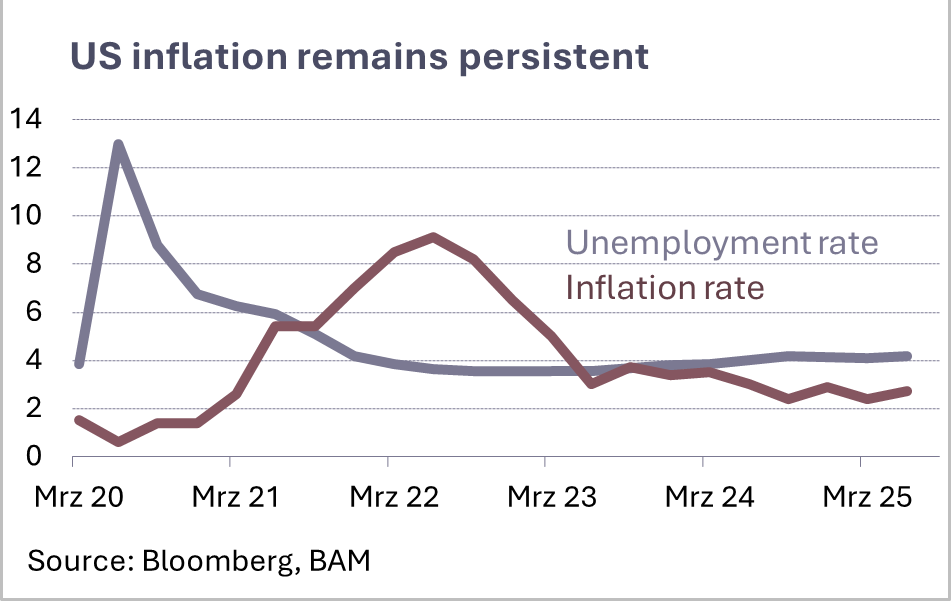

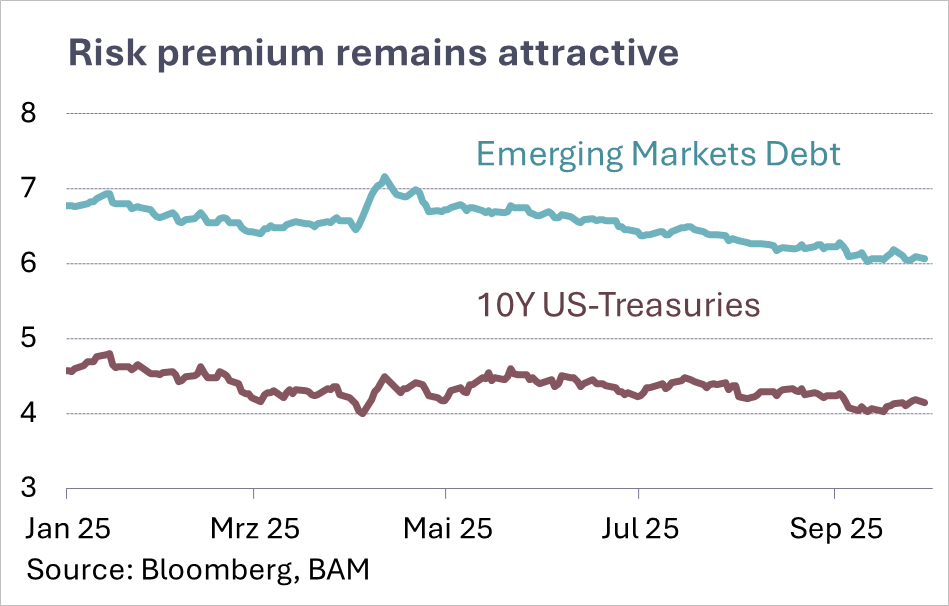

Despite easing inflation, yields on 10-year U.S. Treasuries remain elevated. This is driven less by economic performance than by structural factors: rising debt levels and the recent Moody’s downgrade of U.S. creditworthiness are undermining investor confidence – leading to risk premiums.

The consequences are serious: refinancing is becoming more expensive for the U.S., narrowing fiscal policy leeway and raising the risk of a dangerous debt spiral. Typically, such an environment would support the dollar. However, capital has increasingly shifted toward gold (2025 YTD return in USD: +25.8%) and selectively into crypto (Bitcoin: +15.1%) – clear signs of growing skepticism about the dollar as a reserve currency.

In Japan, long-end yields are starting to rise. After decades of ultra-loose monetary policy, a return to market-driven rates is slowly unfolding. The Bank of Japan is attempting to maintain control – but volatility remains high.

In Europe, the ECB has paused its easing after two rate cuts. Uncertainty around wages, energy prices, and political risks calls for caution. Switzerland presents a unique situation: real interest rates are very low, and the yield curve is now mostly driven by expectations and speculation – actual interest rate signals are hard to find.

The interest rate environment remains fragile. Investors should actively manage duration and currency risks – standard solutions no longer suffice.