Solid Growth – But Rising Geopolitical Risks

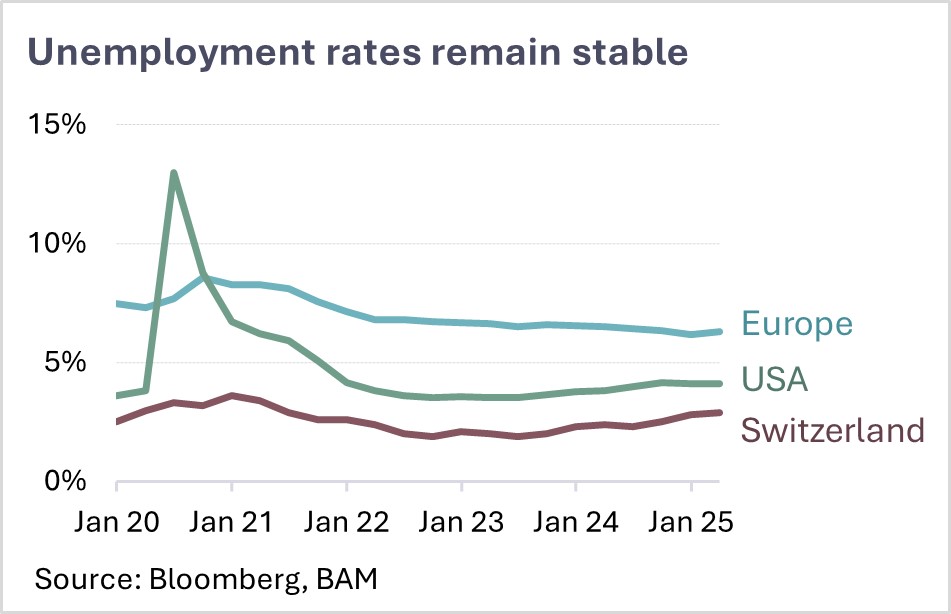

The global economy continues to show surprising resilience. The U.S. labor market remains robust, with unemployment below 4% and strong demand persisting in industry and construction. Switzerland also enjoys a stable employment situation, though initial signs of weakness are emerging in manufacturing.

Europe presents a mixed picture – Southern Europe is benefitting, while Germany remains under pressure. Japan, for the first time in years, is experiencing stable inflation – marking the end of deflation fears and paving the way for a gradual normalization of monetary policy.

Globally, consumer spending remains a key pillar – supported by stable real wages and favorable interest rate conditions. However, risk factors are mounting: U.S. tariffs on Chinese goods are eroding trust, and geopolitical tensions are increasing – driven by the ongoing war in Ukraine and the escalating situation around Iran.

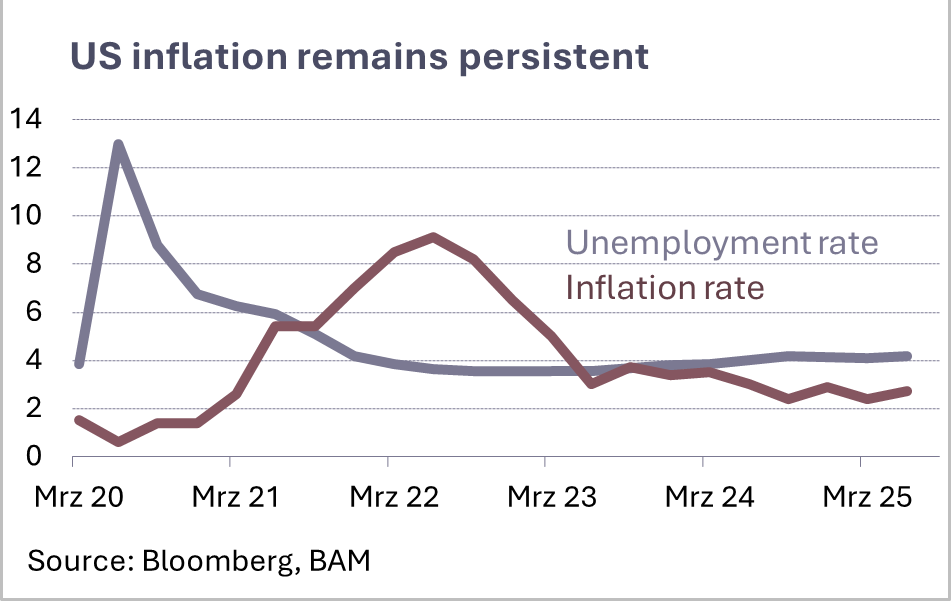

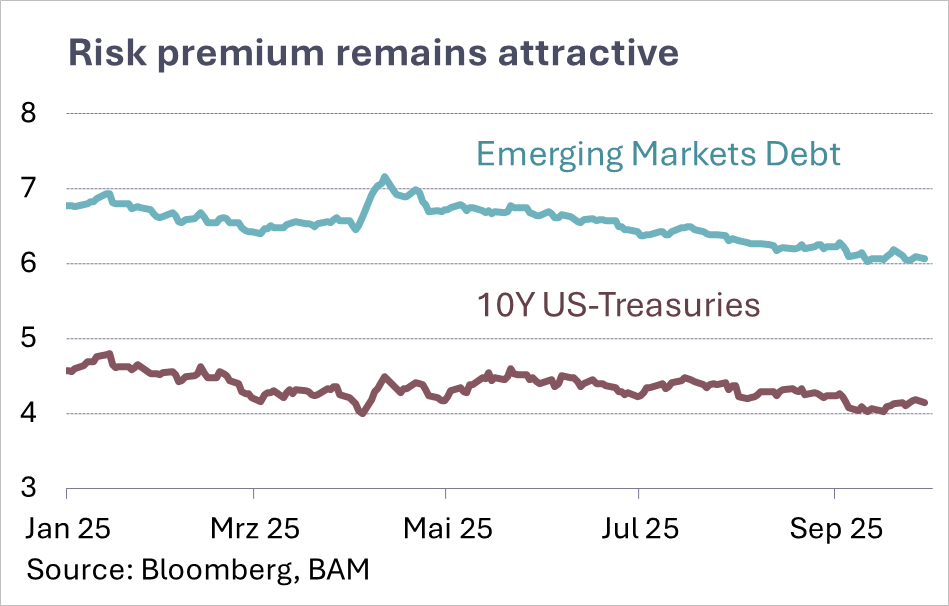

Central banks are staying the course. Rate-cutting cycles continue in Europe and Switzerland, while the U.S. Fed pauses. Although markets are pricing in further easing, it remains unclear whether this is justified in light of geopolitical uncertainty and solid macro data.