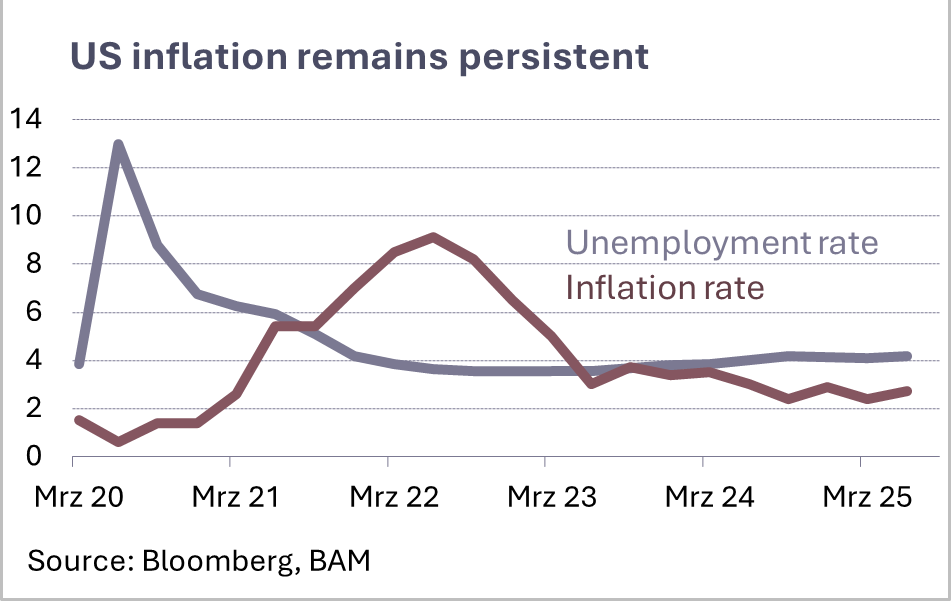

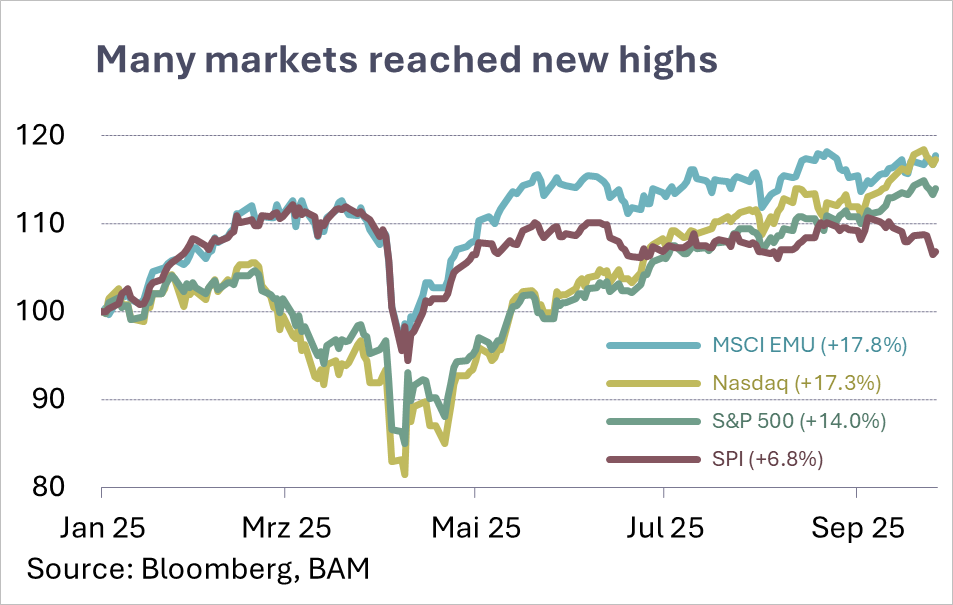

In the first quarter of 2025, the markets were shaped by the behavior of the national banks. The US economy weakened and inflation fell only moderately, meaning that the Federal Reserve saw no scope for interest rate cuts. In addition, political uncertainties, in particular possible trade tariffs, weighed on market sentiment. The US stock markets reacted cautiously as investors expected growth to slow.

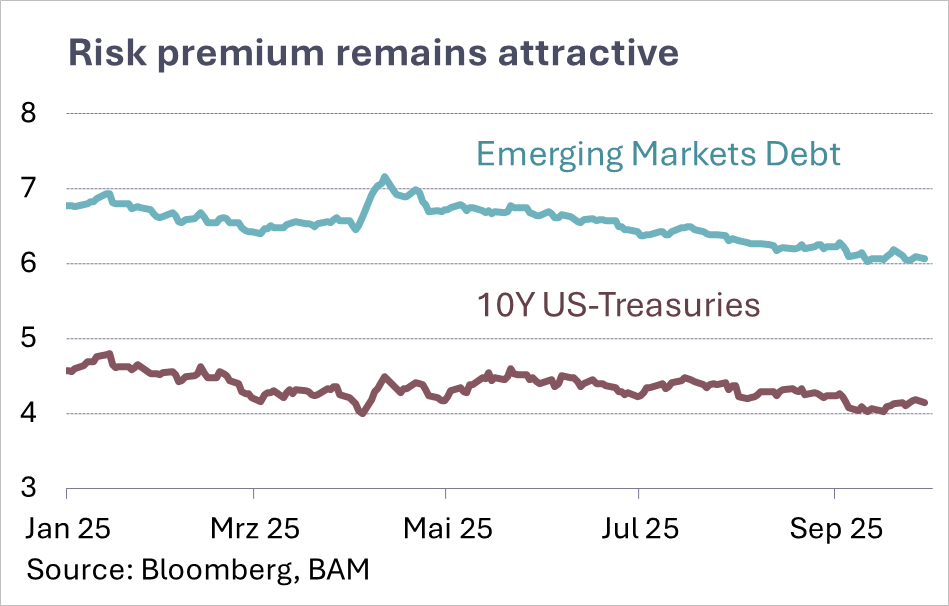

In Europe, the ECB cut interest rates twice in order to support the economy. Planned investments in defence, infrastructure and climate projects should provide an additional economic boost. In Germany in particular, there is the prospect that the new government could push ahead with this course. The European markets performed solidly, buoyed by fiscal support and hopes of stronger growth impetus.

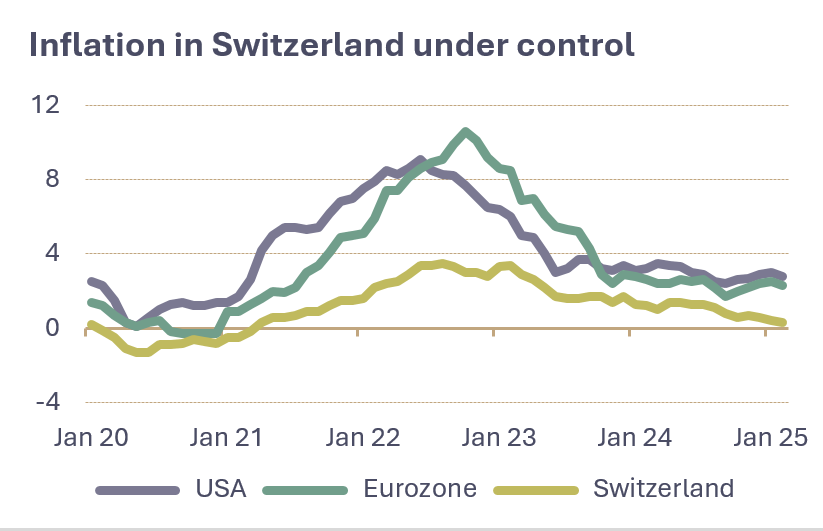

The SNB also acted to support the market in Switzerland. The fall in inflation made the renewed interest rate hike possible. The stock market reacted positively and received additional tailwind from the resilient economy.

Outlook for the second quarter

The Fed could come under pressure in the second quarter as the first signs of recession emerge, making a rate cut more likely. The ECB is likely to continue its moderate course, while the SNB is adopting a wait-and-see approach following the latest measures.

Historically, stock markets tend to perform weaker in the second quarter. While many negative factors may already be priced in in the USA, European stock markets are likely to be more susceptible to corrections. However, the forthcoming government investments could have a supportive effect and stabilize the economic environment.