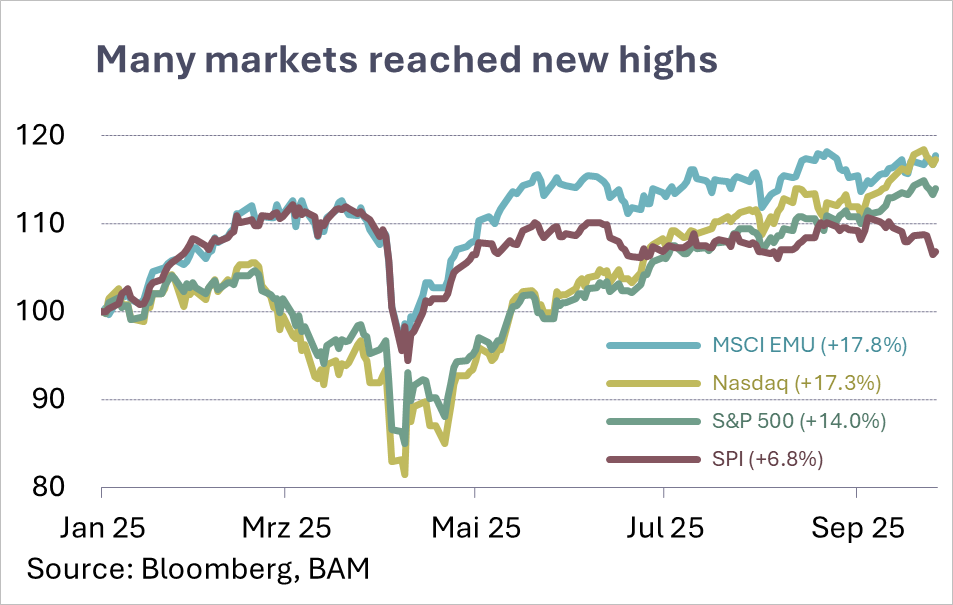

Slight overweight in equities and real estate

The developments of the past quarters and the analysis of the forecasts for the coming months confirm the current weighting of the tactical asset allocation.

We are sticking to our fundamentally neutral positioning and remain slightly overweight in equities (Switzerland and USA) and Swiss real estate.