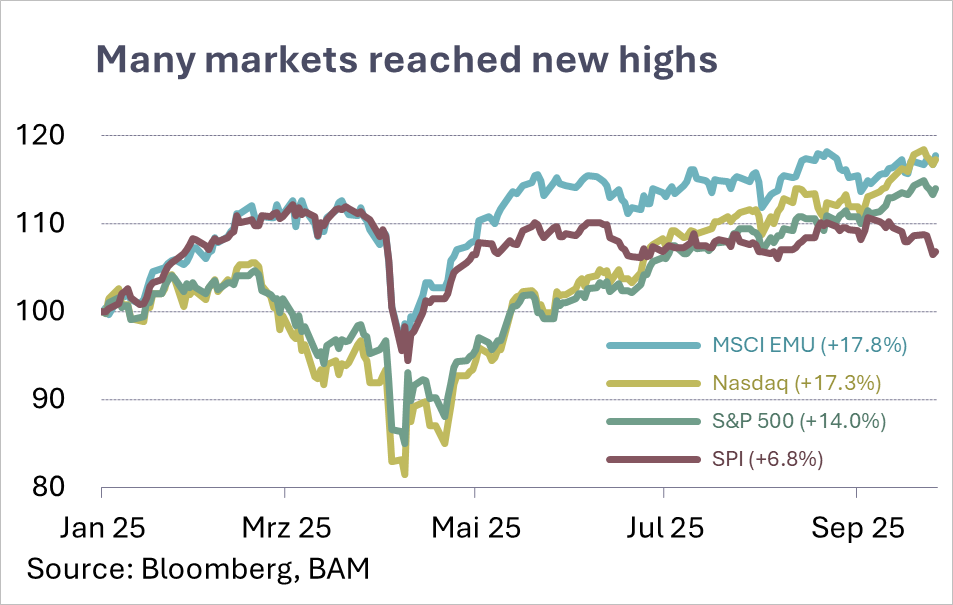

New record highs: driven by tech, supported by falling rates

As summer draws to a close, global equity markets have shown remark-able strength in the third quarter. Numerous indices have reached fresh highs, fuelled primarily by technology stocks. Everything linked to artificial intelligence, cloud computing, or data infrastructure continues to enjoy robust demand.

So far, the main beneficiaries have been the large tech giants, while producers of specialized machinery, infrastructure components, and semiconductors have lagged. Yet this segment could offer catch-up potential once new investments in production capacity gather momentum. Corporate earnings have so far remained solid. Many companies have been able to defend their margins and even surprise with stable to slightly rising results. This earnings momentum is a key driver of the markets, partially offsetting stretched valuations. Still, the room for further upside is narrowing. Valuations are demanding, and any disappointment could trigger corrections.

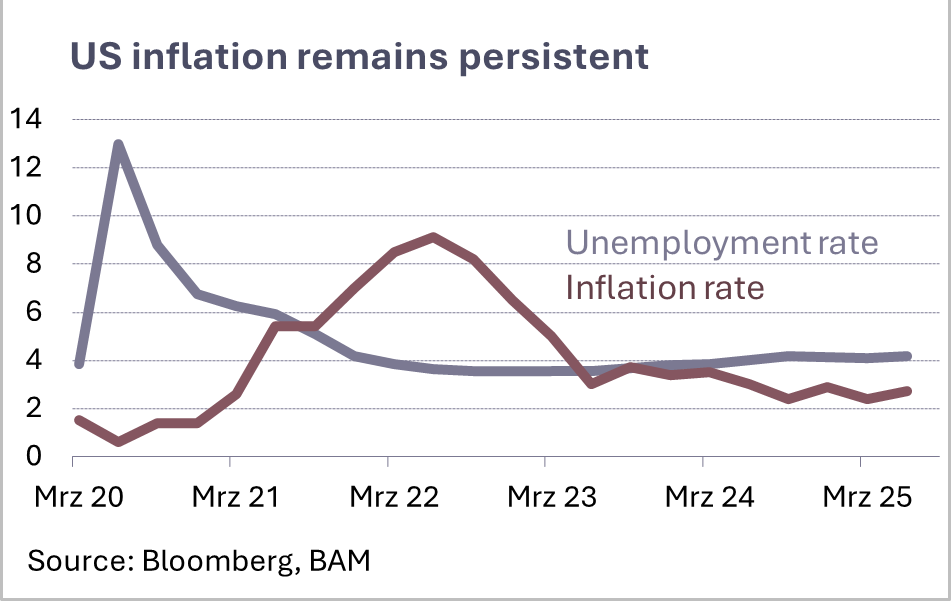

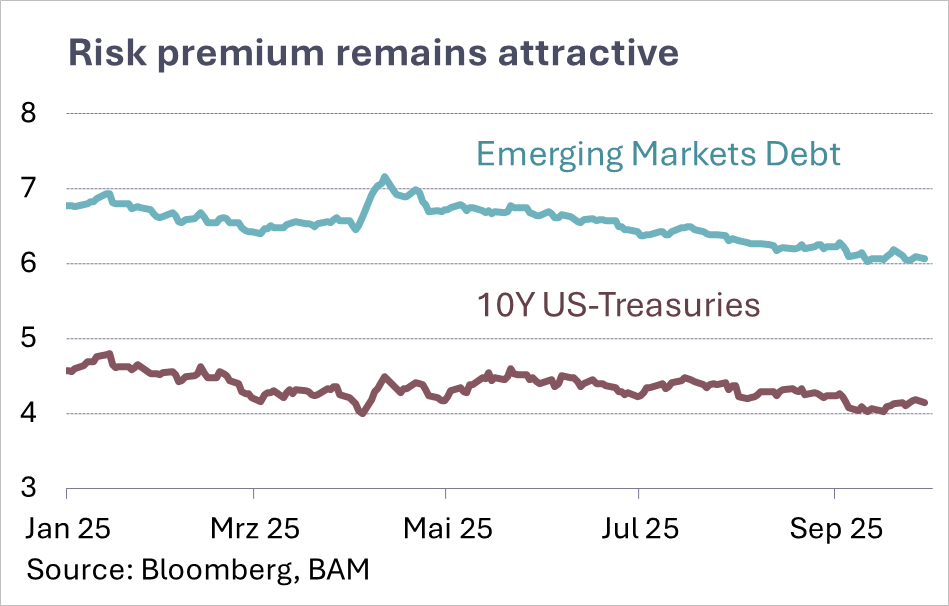

Falling interest rates provide additional support. The Fed’s first rate cut of the current cycle and expectations of further steps ahead are easing financing costs and enhancing the relative appeal of equities over bonds. This continues to bolster stock markets.

Looking ahead, demand in the technology sector is likely to remain strong. Growth areas such as cloud and AI still demand massive investments. At the same time, the need for diversification and sustainable profit sources is rising. Overall sentiment remains constructive, but selective positioning is becoming increasingly important.