New CEO Laurent Freixe has quickly shown his deep understanding of the company and ability to set clear strategic priorities. In personal meetings, he impressed with thoughtful analyses of both opportunities and challenges.

Nestlé is once again focusing on its core business, after having underinvested in this area for too long. Cost efficiency measures are being implemented without compromising innovation. Shareholders benefit from a higher dividend, and acquisitions are only being pursued when they make strategic sense. If financial resources remain, share buybacks are being considered.

Employee motivation is another clear focus. Nestlé remains committed to Switzerland as its home base. According to Freixe, US tariffs pose limited risk, as the company mainly produces locally. In the long run, consumers will not accept price increases due to tariffs.

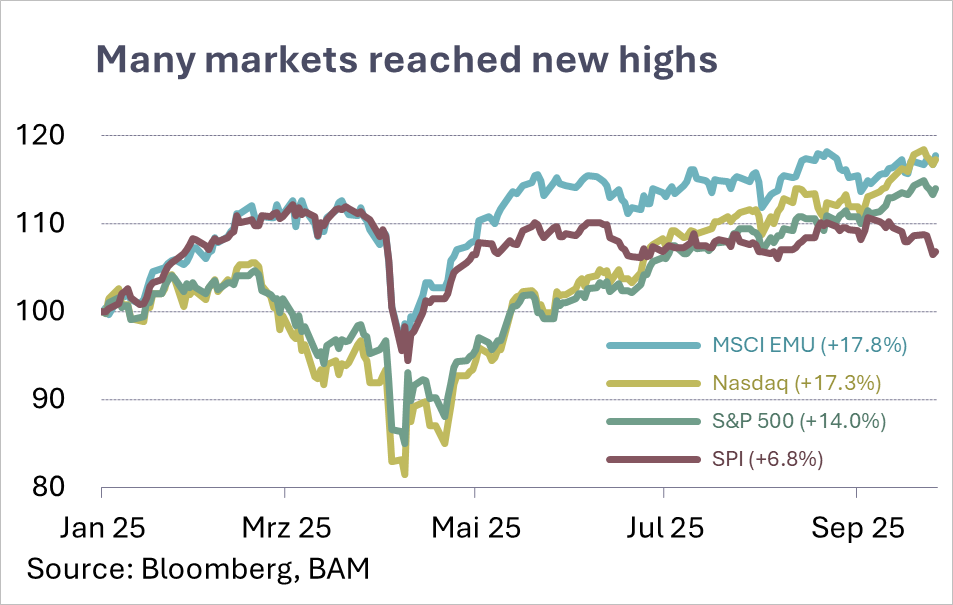

Nestlé shares have shown a strong performance since the beginning of the year. For the long-term, the company remains a solid investment opportunity with stable cash flows and an attractive dividend, making it a compelling choice for investors.