MARKET INSIGHTS

Volatility on the financial markets increased noticeably in the third quarter. There were various reasons for this. US labour market figures were disappointing in both July and August, giving rise to fears of a hard landing for the economy. In China, the real estate market still failed to find its footing and the price decline led to a reluctance to purchase among Chinese consumers – especially for European luxury goods. The megatrend there appears to have been broken, anyway for the time being. The same applies to the hype surrounding artificial intelligence. Investors are increasingly asking themselves whether the huge investments made by the major tech companies Microsoft, Google and Meta will ever pay off.

Bond markets benefited from the uncertainties described above. Interest rates in the US and the eurozone fell by 64 and 37 basis points to 3.75% and 2.13%, respectively. In Switzerland, the yield for ten-year Swiss Government Bonds fell from 0.6% to a very low 0.41%.

Central banks did not remain inert in this environment. In order to minimize the risks of a hard landing for the economy, the US Federal Reserve lowered key interest rates to 4.75% – 5.0% for the first time since March 2020. The European Central Bank and the Swiss National Bank (SNB) continued their cycle of interest rate cuts. At his last meeting as Chairman of the SNB, Thomas Jordan lowered interest rates by 25 basis points to 1%, as expected.

The uncertain environment combined with lower interest rates also benefited gold (quarterly gain of 14.3%) and the Swiss franc, which rose by 6% and 2% against the dollar and the euro, respectively.

Stock investors were partially confronted with significant price losses during the course of the quarter, which, however, were quickly recovered. This was owed to the prospect of lower interest rates and a favourable underlying earnings trend for most companies. Overall, the performance figures for the major stock markets were as follows: S&P 500 5.4%, Euro Stoxx 4.5% and SPI 2.5%.

In Switzerland, Nestlé’s poor performance gave rise to comments. The share lost 7.1% in the third quarter and is currently trading approximately 35% below its highs of December 2021. Rather than innovation and growth, Nestlé increased its earnings per share largely through debt-financed share buybacks. The food multinational is now to be brought back on track with a change of CEO. Conversely, there were also some good performers notably in the SMIM, the mid-cap segment of the market. Belimo was the best performer with a price gain of 33.5%. With its innovative product range, the company is benefiting from the data centre growth.

In the fourth quarter, we see equity markets caught between a weakening economy and central banks trying to stem the tide with interest rate cuts. This may result in a volatile sideways trend for the present, with good chances for a rally towards the end of the year.

Giorgio Saraco

Partner

Economy

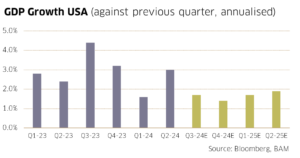

The US economy grew by a solid 3% in the second quarter. This pace is unlikely to be maintained in the second half of the year, lacking positive impulses. Unemployment is continuously rising and the Purchasing Managers’ Index shows that manufacturing is weakening.

Moreover, the government’s fiscal stimulus is drying up. However, there are factors that speak against a sharp slowdown or even a recession – such as a robust financial situation of private households, the decline in inflation, including cheaper petrol, and interest rate cuts, which lead to lower mortgages rates.

At the end of September, the Chinese government responded to the ailing real estate market with some new stabilising measures. These included lowering interest rates, easing mortgage repayments and injecting capital into six large state-owned banks. These measures might have a mildly positive effect, but are not likely to solve the fundamental problem that many private individuals have lost a lot of money with real estate investments.

The economic outlook for the eurozone has darkened further. The Purchasing Managers’ Index (PMI) for manufacturing fell by one point to a low 44.8 in September. The services sector, which had previously performed better, also lost momentum recently and the respective PMI noted barely above the expansion mark at 50.5 points. With this data, the economy is unlikely to grow much more by the end of the year. All hopes are pinned now on consumers, whose purchasing power is likely to increase thanks to lower inflation.

EQUITIES

Equity markets got off to a similarly poor start in September as they did in August. Yet, the central banks’ interest rate cuts and new stimulus programs from the Chinese government gave equities a bit of a boost over the course of the month.

Overall, most stock markets performed slightly positively in September. The Euro Stoxx and the S&P 500 gained 2.3% and 1.7%, respectively. However, the SPI was unable to keep up with a performance of -1.1%, as the stocks of all three heavyweights ended with a loss. Small and medium-sized companies performed better, though, recording a gain of nearly 1% in September.

Equity markets are likely to remain volatile up to the US presidential elections on 5th November. It cannot be ruled out that new trade restrictions against China will be announced again for tactical reasons. However, we do not expect a major market decline because the prospect of interest rate cuts will have a supporting effect.

INTEREST RATES

Bond markets have benefited from the economic uncertainties in recent weeks, which has resulted in interest rate cuts. In our view, further declines would only be possible if the economies were to slide into a recession. However, we do not expect such a scenario to materialise. In the US, as in other countries, inflation has eased noticeably. The reasons for this are falling commodity prices, an easing in wage pressure and a continuing improvement in goods supplies, which is weighingdown on prices. In Switzerland, the strengthening of the Swiss franc also helped. The SNB therefore lowered its inflation outlook on 26th September significantly and even sees further downside risks. Against earlier assumptions, the latest interest rate cut to 1% is therefore unlikely to be the last one in this cycle. This also applies to the US, where the consensus expects interest rates to end up at around 3% in a year’s time.

Imprint

© BAM 2024. All rights reserved.

Publisher: Belvédère Asset Management AG

Authors: Giorgio Saraco, Matthias Wullschleger

Stop press: 27.09.2024.

Matthias Wullschleger

Senior Investment Analyst

Disclaimer

The information and opinions expressed in this publication are for general purposes only and do not constitute a solicitation by Belvédère Asset Management or an offer or recommendation to buy or sell any financial instruments or to engage in any other transactions. The aforementioned information and opinions are based on sources that we deem reliable. However, we cannot provide any warranty or representation as to the reliability, completeness, or accuracy of these sources. To the extent permitted by law, we exclude any liability for direct, indirect, or consequential damages, including loss of profit, that may arise from the information published. Interested investors are strongly advised to consult their personal client manager before taking any decisions based on this document so as to ensure that their specific financial circumstances, needs and investment objectives can be duly taken into account as part of comprehensive and detailed advice.