MARKET INSIGHTS

Stagnation, energy crisis, weakness in the export sector, increasing absenteeism and the latest news of VW plant closures in its home market. These and similar reports have been reaching us from Germany in recent months. What has happened to Europe’s former model economy.

Let’s take a look back: the country was struggling with massive issues at the turn of the millennium and was then labelled the sick man of Europe. In response, the government launched “Agenda 2010” – a programme that involved a liberalisation of the labour market as well as growth reforms. This enhanced Germany’s competitiveness and ushered in a golden era, which lasted up to around 2017. Then, however, spoiled by its success, the country became complacent. At the same time, southern European countries embraced reforms in the wake of the euro crisis and became more competitive.

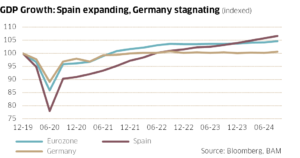

In Germany, the situation deteriorated further as a result of cyclical factors following the covid pandemic. The shift in consumption towards services was hurting the economy, as its strength lies traditionally in the industrial sector. Other negative factors included a weak export market China and higher energy prices due to the Ukraine crisis. Consequently, the German economy has been stagnating since the end of 2022 and currently finds itself even on the verge of a recession.

How does Germany’s weakness now affect Switzerland? Far less than one might think. In the 1990s, Germany was by far Switzerland’s most important trading partner, accounting for up to 25% of exports. However, its importance has steadily declined over the years and currently stands at 12%. In 2020, the country was ultimately superseded by the USA as Switzerland’s key export market. Naturally, Asian markets have also gained in significance. The Swiss economy has thus successfully realigned itself and the old saying “when Germany coughs, Switzerland has a flu” holds less and less true.

What are then the medium-term economic prospects for our neighbour to the North? One thing is clear – the challenges are big. They include a shortage of skilled labour, dated infrastructure due to underinvestment, and question marks over energy policy. What is needed quite urgently is a clear-cut energy policy, reduction in excessive red tape, and faster approval processes for infrastructure construction. Germany does have the financial means and is very well positioned with a low budget deficit and a national debt of 63% of GDP. It has also got a very good economic basis in the form of so-called hidden champions, i.e. small and medium-sized companies that are market leaders in their niches far off the public focus. Germany boasts around 1600 of these – more than any other country in the world. So, let’s not write the country off prematurely. If the German government makes the right adjustments, this could bring the country back on a path of moderate growth.

Giorgio Saraco

Partner

Economy

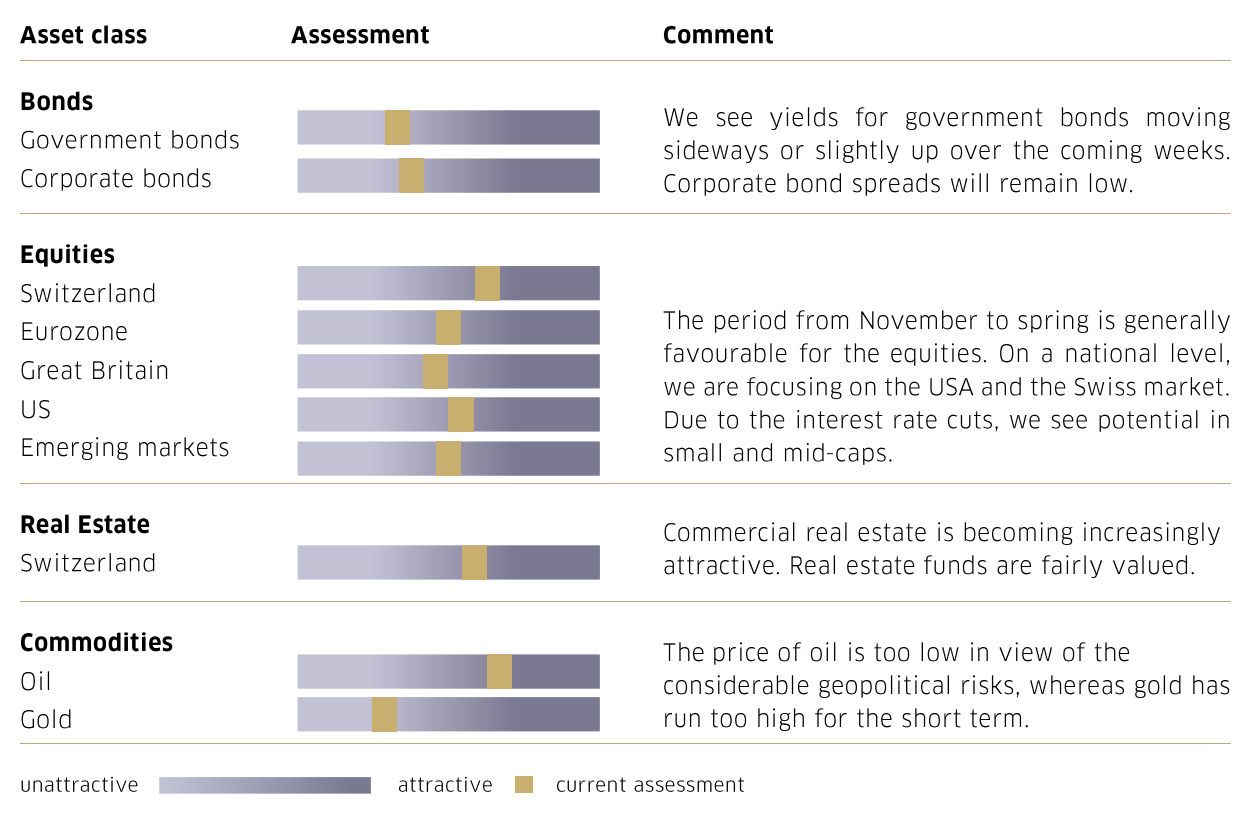

The US economy remained on a solid growth path in the third quarter. Supported by private consumption, GDP grew by an annualized 2.8% compared to the previous quarter. The labour market recovered significantly after a short-term weakness in September and is now a key driver for the strong consumption. Overall, the US economy is still the best performing of the three major global regions.

The Chinese government expanded its stimulus measures in October. However, market observers agree that they are still not sufficient to stabilize the real estate market. More public funds would be needed to destock the real estate market meaningfully and scale up social spending for the lower-income segments of the population. All in all, the challenges are still abundant, and the risk of a deflationary spiral persists.

For once, economic figures in the eurozone surprised on the upside. GDP rose by 0.4% in the third quarter, which was above the expected 0.2%. The area benefited from a general recovery in private consumption and – on a national level – Spain with an above-average growth of 0.8%. Nevertheless, the euro zone is still facing significant challenges. These include notably weak foreign demand and new trade restrictions. Nevertheless, the labour market should remain quite solid, and the interest rate cuts ought to help in the medium term.

EQUITIES

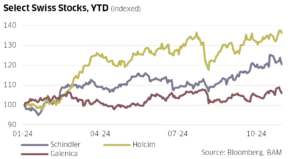

Equity market performance was mixed in October. In the US, the market benefited from the strong economy and overall better-than-expected third quarter earnings reports. One example is Netflix (+6.3% in October) with a significant increase in profitability. The S&P 500 and the Nasdaq rose by +1.0% and +2.3%, respectively in October. By contrast, Euro Stoxx and the SPI proved to be struggling, with month-on-month declines of -2.2% and -1.9%. The blue chips Novartis and Nestlé weighed on the performance of the SPI. Nestlé is contending with some growth and innovation issues that are unlikely to be resolved any time soon. However, there were also some bright spots, such as Holcim (+4.1%), Schindler (+2.0%) and Galenica (+1.9%). Holcim achieved a further increase in margins in the third quarter and the planned listing of its North American business is expected to generate additional shareholder value.

Now that the difficult months of September and October are behind us, there are good chances that equity markets could be in for a favourable run towards the year-end. The key drivers are good corporate earnings from the USA, further easing on the inflation front, interest rate cuts by central banks, and the Chinese government’s willingness to support the economy.

INTEREST RATES

Having taken a dip in September, yields for long-term government bonds experienced a signi-ficant rebound in October. For instance, in the USA, they rose back above 4%, which was due to better economic data, but also concerns about excessive budget deficits, regardless of who will be the next president. We consider the risk of a recession to be relatively low. Therefore, yields are likely to remain at current levels.

Central banks will continue to cut interest rates. The European Central Bank is likely to be the fastest in cutting rates, given the weak economy and a significant decrease in inflation, while the US Federal Reserve is more likely to take its time. The Swiss National Bank’s policy will fall somewhere in between these two.

Imprint

© BAM 2024. All rights reserved.

Publisher: Belvédère Asset Management AG

Authors: Giorgio Saraco, Matthias Wullschleger

Stop press: 30.10.2024.

Matthias Wullschleger

Senior Investment Analyst

Disclaimer

The information and opinions expressed in this publication are for general purposes only and do not constitute a solicitation by Belvédère Asset Management or an offer or recommendation to buy or sell any financial instruments or to engage in any other transactions. The aforementioned information and opinions are based on sources that we deem reliable. However, we cannot provide any warranty or representation as to the reliability, completeness, or accuracy of these sources. To the extent permitted by law, we exclude any liability for direct, indirect, or consequential damages, including loss of profit, that may arise from the information published. Interested investors are strongly advised to consult their personal client manager before taking any decisions based on this document so as to ensure that their specific financial circumstances, needs and investment objectives can be duly taken into account as part of comprehensive and detailed advice.