Switzerland’s key interest rate now stands at 0.25%, close to the zero boundary once again. A weaker franc could temporarily increase inflationary pressure. Given the limited scope for further cuts, another rate move in 2025 would be a surprise. Although government bonds have become less attractive due to already low yields, they still serve as a safe haven.

The ECB, with its two recent rate cuts, has underlined its commitment to guiding inflation back towards the 2% target. At the same time, it aims to stimulate investment and consumption. We expect the easing policy to continue, though in a more measured fashion.

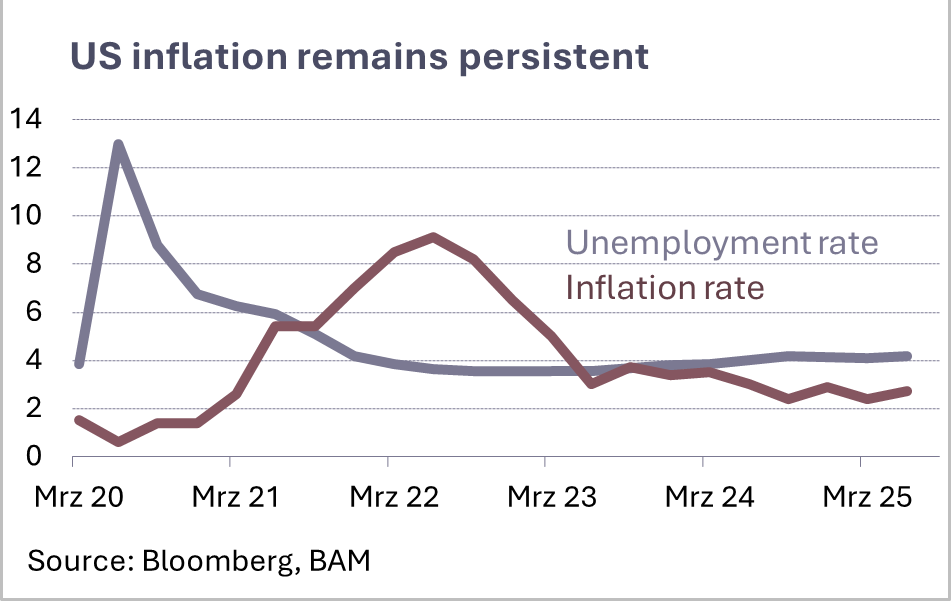

In the US, the situation remains largely unchanged. The Fed is in observation mode, with 10-year Treasury yields still above the 4% mark. A key challenge lies in evaluating the potential inflationary effects of political decisions, such as the introduction of new trade tariffs. The Fed must avoid triggering a recession with hasty decisions – though this is not our base case.

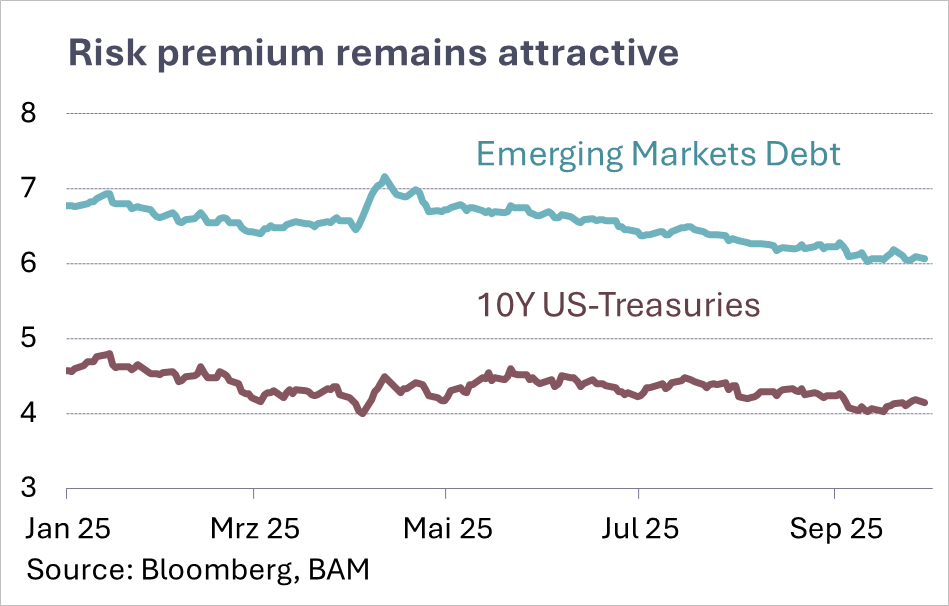

We therefore recommend a neutral duration strategy across CHF, EUR, and USD. The divergence in central bank policies, combined with global macro developments and new investment programmes (especially in Europe and Germany), is likely to keep the interest rate environment volatile, particularly for longer maturities.