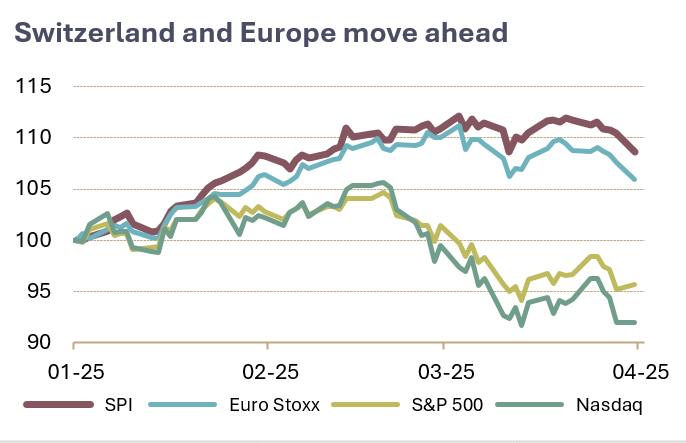

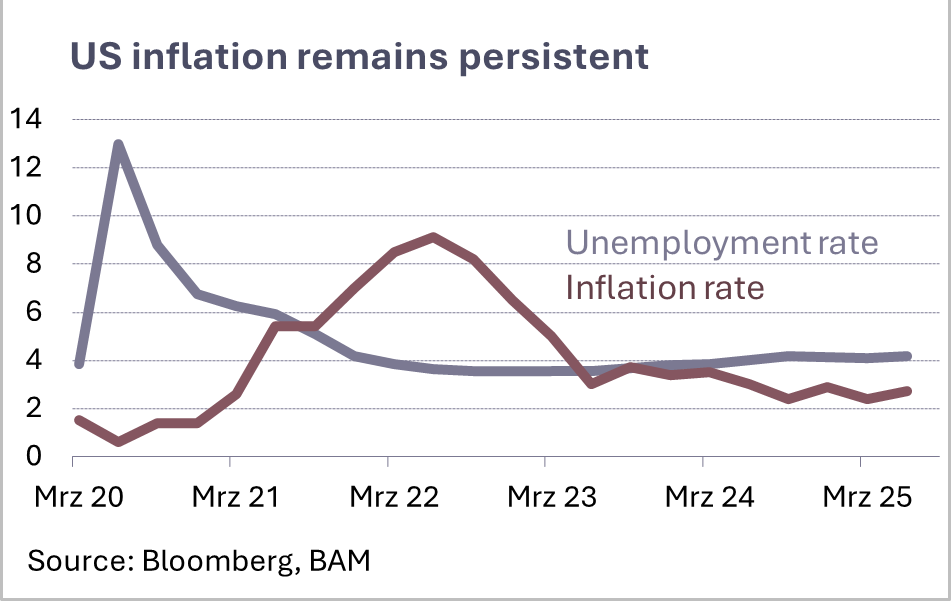

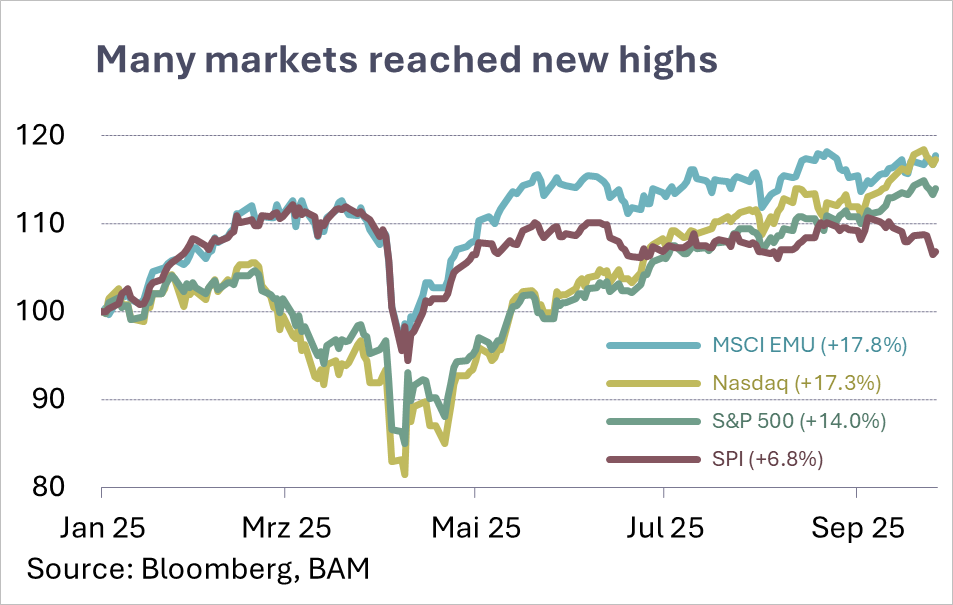

In 2024, the US market was led by the “Magnificent 7” tech giants. But in Q1 2025, that trend reversed: their share prices fell sharply, dragging the S&P 500 down by 4.3%. This was due to high valuations, uncertainty over new trade tariffs, and a strong US dollar – also supported by persistently high interest rates.

European stock markets saw a rally. The Euro Stoxx index rose by 5.9%. More attractive valuations compared to the US, falling interest rates, large-scale investment programmes, and stabilising policy led to growing investor confidence. Switzerland’s SPI also started the year on a positive note (+8.6%). Defensive heavy-weights such as Roche, Novartis and Nestlé – after a prolonged slump – led the pack.

In Q2, we expect US equities to recover from recent lows, while European and Swiss markets may enter a consolidation phase after the dividend season. Key factors will include US trade policy developments, progress in the Ukraine conflict, declining interest rates, and a stable (albeit modest) economic growth backdrop. For Switzerland, we remain positive. Modest GDP growth is supported by strong domestic demand and prudent action from the Swiss National Bank. However, external factors such as a strong currency or weakness among key trading partners may weigh on exporters.

We therefore favour a slight overweight in US and Swiss equities, to particularly benefit from their relative stability and defensive characteristics.