Cooling labour market and persistent inflation

The global economy presented an increasingly mixed picture in the third quarter. Asian markets appear to have regained momentum, as solid growth figures from China and India suggest, helped in part by the weaker dollar.

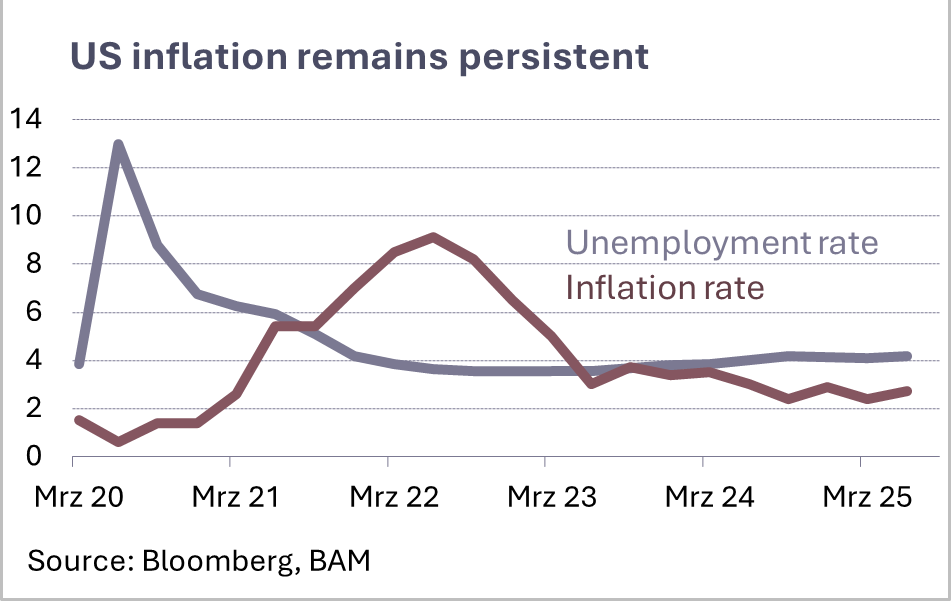

In the U.S., however, the labour market is clearly losing steam. Hiring activity has slowed, and data revisions have softened what previously looked like stable numbers. As a result, wage pressures are easing, yet inflation remains stubbornly high. Current rates stand at around 2.9% in the U.S., 2.0% in the Eurozone, and close to zero in Switzerland. Housing costs and services continue to act as the most persistent drivers. This leaves central banks with a delicate balancing act. Interest rates cannot be cut aggressively while prices fail to show a clearer decline.

At the same time, pressure is mounting to support growth. Despite these tensions, many companies still display remarkable resilience, supported by robust business models and solid consumer demand. The slowdown is visible, but the situation does not yet point to an acute recession. Nevertheless, risks remain. High import costs, fragile supply chains, rising interest rates, and ongoing trade policy uncertainties, especially regarding potential tariffs and the tensions between the U.S. and China, are weighing on the outlook. Wage developments could also reignite inflationary pressures.

For Switzerland, the environment is particularly challenging. On the one hand, the stalled U.S. trade deal is adding pressure on export industries that depend heavily on global markets. On the other, the strong Swiss franc reduces competitive-ness for domestic producers, even though it continues to provide stability.