Tactical adjustments: Focus on Emerging Markets Debt

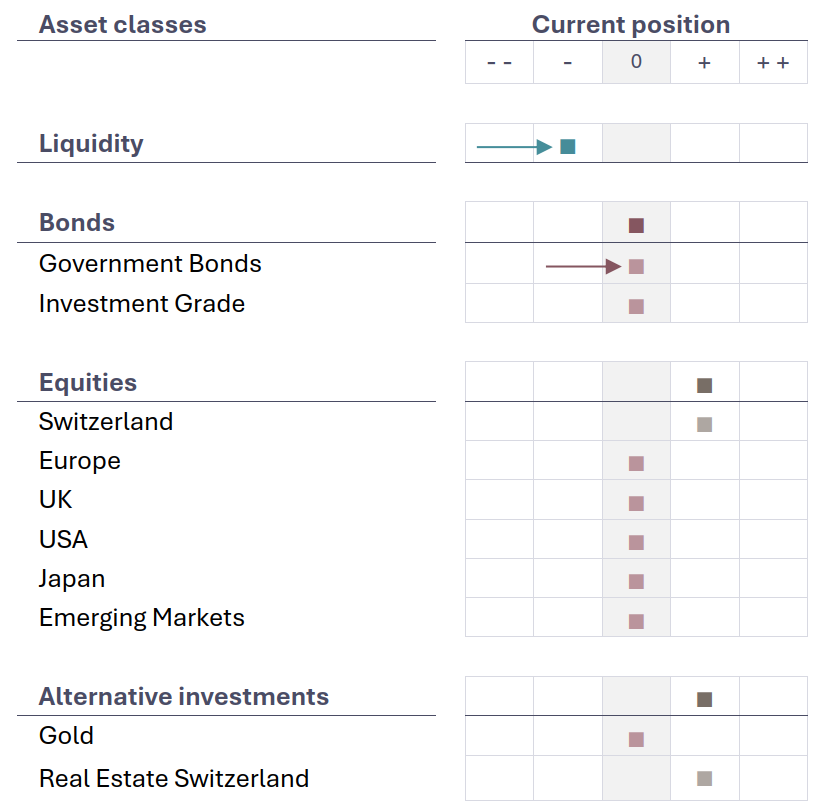

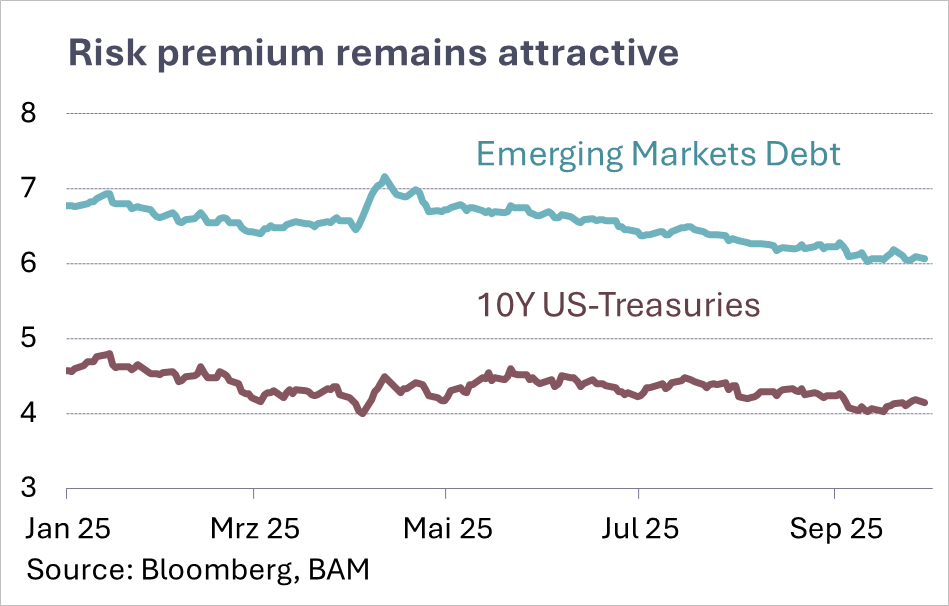

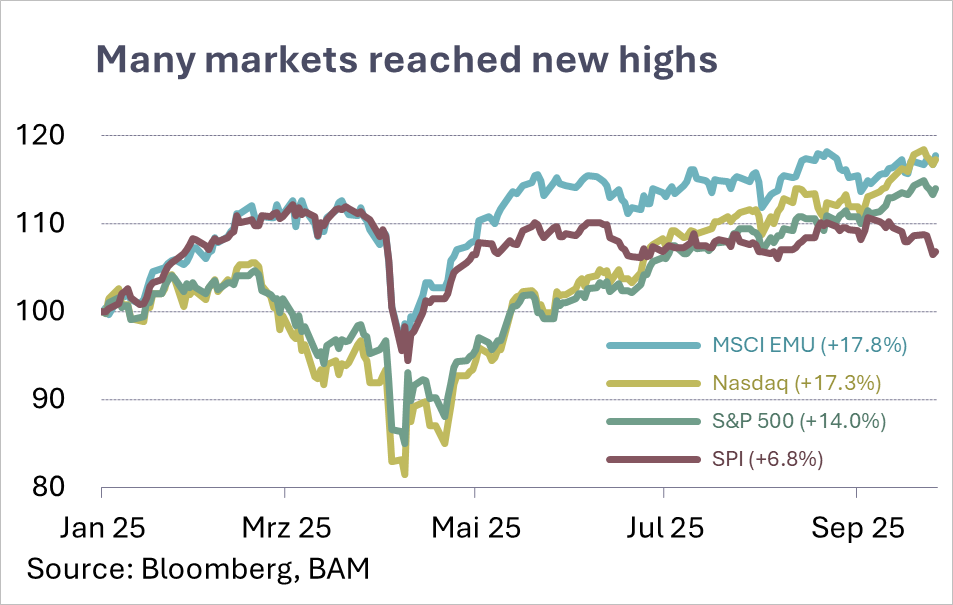

The tactical changes concern the slightly reduced underweight in liquidity and fixed income. The cut in global government bonds (mainly U.S. Treasuries) is more than offset by a further increase in emerging markets debt. We remain cautious in CHF and EUR as we see little upside. Overall, we are now back in a neutral position.

In equities, we maintain the existing allocation. Swiss stocks remain over-weight for the time being, as we expect a trade agreement with the U.S. soon. In Europe, we anticipate that large-caps will begin to catch up. Swiss real estate continues to benefit from low interest rates and the abolition of the imputed rental value tax.