Preference for Quality: Selective Overweight in Swiss Assets

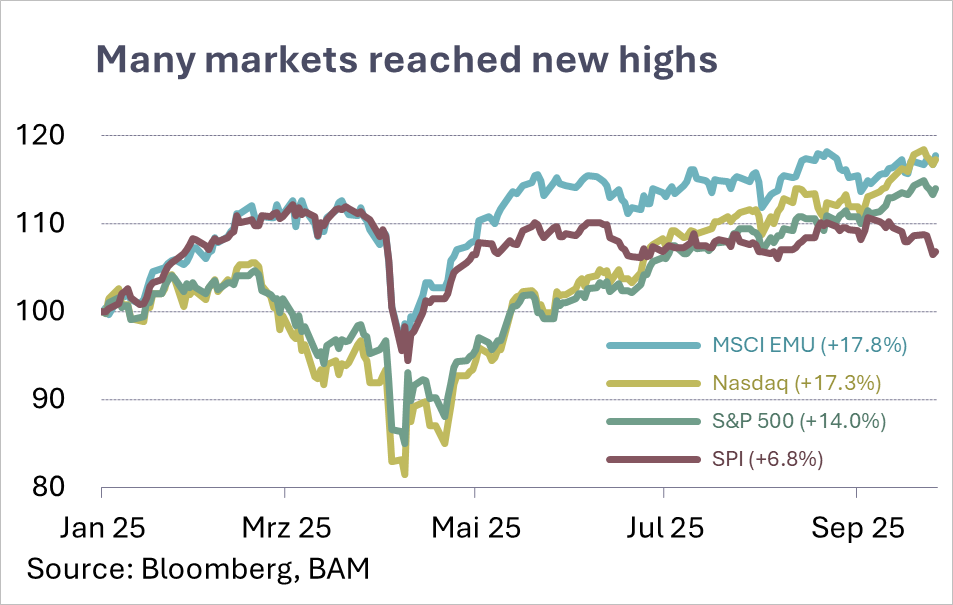

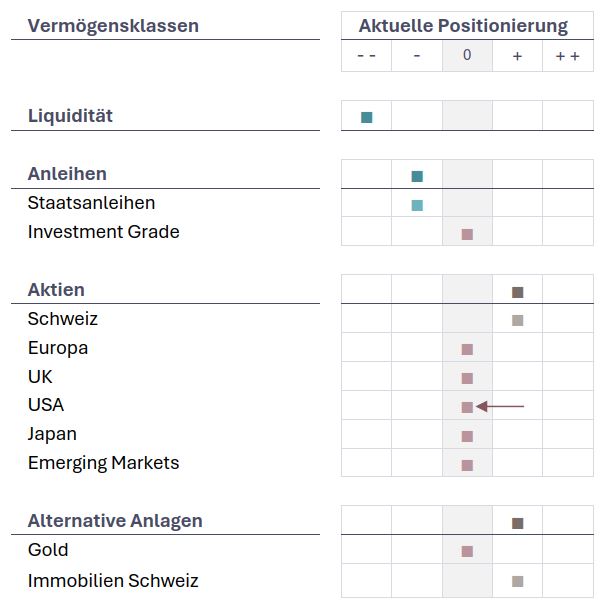

Our tactical positioning remains broadly neutral – with a slight overweight in Swiss equities and real estate. Following recent strength, we now rate U.S. equities as neutral.

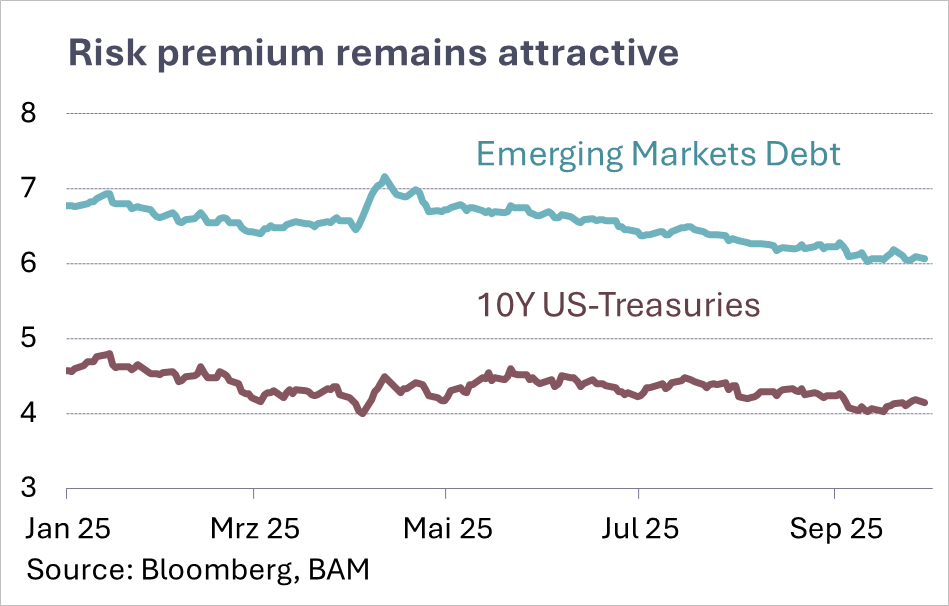

Bonds in CHF and EUR remain unattractive, particularly government bonds. In the U.S., select short-duration corporate bonds offer attractive opportunities, though with elevated volatility. We maintain a neutral duration stance across currencies due to diverging monetary signals. We’ve newly added a tactical position in emerging market bonds – at the expense of global sovereigns.