MARKET INSIGHTS

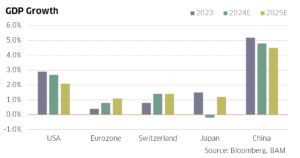

US dominance – this term sums up the economic and stock market developments of the past year in a nutshell. The US economy defied fears of a recession that prevailed at the beginning of the year, achieving growth of 2.7% and outpacing other economies. The eurozone and China on the other hand were disappointing, notably due to unresolved property market issues. Switzerland fell somewhere in between, with GDP growth of 1.4%. As expected, central banks returned to a cycle of interest rate cuts, with the US Federal Reserve (Fed) acting more hesitantly than the Swiss National Bank (SNB) which reduced its rates to 0.5%. In keeping with its economic strength, the US dominated equity market performance – a trend that was additionally boosted by fantasies surrounding artificial intelligence (AI). The S&P 500 soared by 25.0% and the country achieved by far the highest weighting in the global equity index at over 70%. The performance of the eurozone (+10.2%) and the SPI (+6.2%), where the three heavyweights Nestlé, Roche and Novartis disappointed, lagged well behind the US. Remarkably, Swiss real estate shares performed significantly better at 16.7% (measured by the SReal Index). This was mainly driven by lower interest rates.

Let’s look ahead to 2025: most economists and analysts assume that the US dominance will remain unchallenged. Few are optimistic about the eurozone, and even fewer about China. The problems are weighing too heavily on the real estate market and there are no simple solutions in sight. We also assume that the US economy will perform better than all the world’s other key economies, with the corresponding consequences for the respective stock markets. The major US technology companies are likely to remain important drivers. They generate very high cash flows, which enables them to extend their lead in AI and thus further fuel imagination in this sector. So, everything seems clear – US economic dominance will continue. Or maybe not?

Stock markets thrive on expectations. The higher prices rise, the more companies must exceed them in order to sustain the bull market. However, when prices are low, reversing the trend usually requires very little. This inflection point might emerge during the year – US equities lose momentum and lagging markets are rediscovered. In addition to the eurozone, this includes the Swiss market in particular, where there is a good chance that the three heavyweights Roche, Novartis and Nestlé would perform much better than in 2024, with dividend yields of around 4% and historically low valuations.

Investors will need to consistently review their positions and make timely adjustments. At Belvédère Asset Management, we look forward to supporting you on this journey and wish you a prosperous 2025.

Giorgio Saraco

Partner

Economy

The usual picture did not change much in December. The US economy continues to perform well, almost too well. Therefore, there is a risk that inflation – currently at 3.3% (core rate) – will no longer make any notable progress towards the 2% mark. Hence, the Fed adopted a more cautious stance at its last meeting (see details below in INTEREST RATES). Moderate growth of around 2% is expected for the economy overall.

Meanwhile, the eurozone still faces significant challenges, the core culprit being Germany, where the economy has been stagnating since 2019. After Chancellor Scholz lost the vote of confidence, new elections are scheduled for 23rd February. Economic issues dominate the agenda and most parties are calling for tax cuts, lower energy prices and a reform of the citizens’ benefits (i.e., income support for job seekers) as an incentive to find employment again. Such reforms are desperately needed to get the economy moving and make Germany competitive again.

Although China’s export engine is running smoothly and making life difficult for Germany, among others, domestic demand remains weak due to the ongoing real estate crisis. The measures implemented by the government have led to a temporary increase in house sales, but construction activity remains significantly sub-dued. After a brief rebound in October, private consumption weakened again in November. The government will need to intensify efforts to achieve its growth target of 5% in 2025.

EQUITIES

Led by US technology stocks, equity markets initially trended upwards in December. While most investors thought they were already on Christmas leave, Fed Chairman Jerome Powell shocked the markets on 18th December with the prospect of fewer interest rate cuts than expected. The S&P 500 reacted with a slump of 3%. Equity markets in Europe did not escape unscathed either, but their losses were less dramatic. Overall, the following performances were recorded in December: S&P 500: -2.0%, Euro Stoxx: +0.9% and SPI: -1.3%.

In the Swiss market, winning stocks were few and far between in December. Yet, there were some, for instance Richemont (+12.4%), which held its own in the luxury goods market. Swatch (+3.2%), however, faced challenges due to its focus on the mass market.

Equity markets should benefit from the January effect at the start of the year, which usually propels share prices upward. We expect a continuation of last year’s trends, which means a good performance of US equities. It will remain to be seen over the course of the year whether the other equity markets can break the spell of negative earnings momentum. The stronger US dollar provides a welcome tailwind, especially for Swiss companies.

INTEREST RATES

Among central banks, the SNB moved ahead and surprisingly lowered its key interest rates by 50 basis points on 12th December. Time will tell whether it acted too soon. However, the risk cannot be dismissed. The European Central Bank cut its interest rates by another 25 basis points, which seems sensible given the weakening economy. Although the Fed took a further step, it will have to slow down going forward due to the risk of inflation. It is aiming for two rate cuts in 2025, less than the three to four that markets had previously expected. There has been an upward trend in long-term interest rates in the US and the eurozone. In the short term, the potential for even higher interest rates has probably been exhausted. In Switzerland, yields are already so low at 0.3% that it is hard to conceive of them falling further.

Imprint

© BAM 2025. All rights reserved.

Publisher: Belvédère Asset Management AG

Authors: Giorgio Saraco, Matthias Wullschleger

Stop press: 31.12.2024.

Matthias Wullschleger

Senior Investment Analyst

Disclaimer

The information and opinions expressed in this publication are for general purposes only and do not constitute a solicitation by Belvédère Asset Management or an offer or recommendation to buy or sell any financial instruments or to engage in any other transactions. The aforementioned information and opinions are based on sources that we deem reliable. However, we cannot provide any warranty or representation as to the reliability, completeness, or accuracy of these sources. To the extent permitted by law, we exclude any liability for direct, indirect, or consequential damages, including loss of profit, that may arise from the information published. Interested investors are strongly advised to consult their personal client manager before taking any decisions based on this document so as to ensure that their specific financial circumstances, needs and investment objectives can be duly taken into account as part of comprehensive and detailed advice.